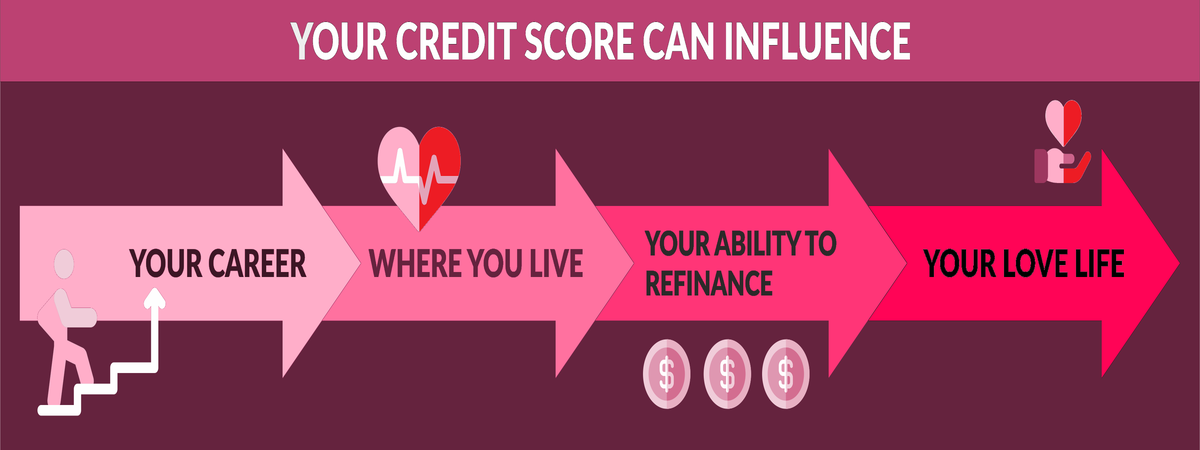

For many lenders, your credit score is an important factor when reviewing your application. This means you might not get approved by most of them when you need cash urgently. One of the options you have is to apply for a loan against a car title with bad credit. This is a loan in which you use your car title as collateral when borrowing. Getting title loans with bad credit is easy because the lender only focuses on your ability to settle the loan at the end of the term. The lender will use this to calculate if you can repay the amount you seek.

Typically, you will not be subjected to a hard credit check, so your credit score is not affected by this process. Approval for the loan will take under 30 minutes, and filling out the loan request form will take you less than 10 minutes. A title loan is ideal when you have a financial emergency, as you can get cash in under 24 hours.

Besides, you can apply for title loans online on your mobile device or computer. A title loan is a type of short-term loan that uses the title of your vehicle as collateral. Discount Car Title Loan Online (dtloans.com) recommends car title loans for consumers who need quick cash but don't qualify for traditional means of financing. Unlike bank loans, qualifying for a title loan is simple and doesn't require a credit check.

Best of all, you can continue to use your car while the loan is outstanding. A personal loan, also known as an installment loan, is a popular loan option for consumers that want to establish a credit history. No collateral is required for personal loans and the loan terms may be longer than 6 months. However, title loans require vehicle pink slip as collateral.

Motorcycles, trucks, SUVs and sports cars qualify for car title loans Moorestown, New Jersey. You may have to check with lenders to find out the loan value you can get on your vehicle. For this reason, you can not solely depend on your credit rating for the cost. It has been seen that most of the auto title loans in Moorestown of New Jersey cost a little more money than the general bank loans. The interest rates are different in different states, but generally, the price is anywhere between 25% a month, or around 300% a year. These rates mean that a person who gets the loan suppose 1,000 dollars will eventually repay 1,250 at the end of a month.

Most of the borrowers do not feel confident in applying for a loan with a low credit rating. Traditional small-dollar installment loans are entirely different loan products, and more like credit union loans or bank mortgages. Payday loans come with no payment plans, except for the requirement to pay the entire balance, known as a balloon payment, at maturity.

This may result in substantial overdraft fees for the consumer. This helps ensure that the consumer can pay off the loan in a responsible and timely manner. TIL lenders never ask the borrower for a postdated check or access to the borrower's bank account. In most cases where the borrower has bad credit, a personal loan or installment loan is hard to get.

Title Loans With No Credit Check Near Me Even after initial approval with a bank or personal loan company, it will still take days or weeks to send in all the paperwork and documents. An unsecured loan, if offered, can carry an interest rate that is actually higher than that of the original debt. The same is true for those who apply for online payday loans or cash advances. Borrowers with bad credit should seek out alternative methods of borrowing if at all possible. The best financing offers will always be a low interest loan from your bank or a credit card cash advance. These will have the lowest interest rates, but it's always difficult to get approved with poor credit.

With traditional bank loans, your credit history serves as your collateral and determines how much money you can get from a loan. But it's incredibly easy to have bad credit, or even no credit at all. At TitleMax, we use the title to your car as your collateral in most states, rather than your credit history.

For auto title loan or pawn services, a vehicle and the vehicle's title are required to be approved for a loan/pawn. Then, once you repay the loan/pawn, you get your car title back. A car title loan is a simple way to get the cash you need, but there are plenty other ways to make money, too.

Car title loansmight appear as a fast way to get your desired money, but there are other loan systems you should give a try before turning to a car title loan. Firstly, you can get a loan from a credit union or finance company. Getting a small loan from a local bank is better than getting it from title secured loan. They even offer a higher loan amount than that of title loans.You can as well request for an unsecured personal loan that won't require collateral like your car. Personal loans also have a low-interest rate than car title loans.

Moreover, instead of going into title loans, you can request an advance cash payment from your employers. Another great substitute for car title loans is to borrow money from friends and family. To borrow from friends and family is better and risk-free than car title loans. You can always appeal to your friends or family members even if you do not meet up their deadlines. All of our title loans are the same and go by many names.

Some people refer to them as auto title loans, car title loans even vehicle title loans. Most title loan lenders in Arizona offer the same type as we do where we do not check your credit. There are other lenders that check further into your personal finances and check your credit.

They require some type of credit check when qualifying you for their loans. " A car title loan is an easy way to get the cash you need using your car title instead of using your credit score.You have bad credit? Blueknight Financial LLC offers car title loans up to $5,000, and we work hard on getting you the most cash possible while keeping an eye on manageable payments. And if you already have a title loan with another company, we'll pay off your title loan and most likely cut your rate in the process. A title loan application is quick and easy because you can apply online and, in many cases, get the money you need the same day. Lenders do not use credit scores to determine your eligibility.

These loans have more flexible repayment terms at a more user-friendly rate than other loan types, such as payday loans. Plus, the amount you can borrow is generally more than other personal loans. In some cases, an online lender may require a security deposit because your credit score is lower than anticipated. Even if you have bad credit that doesn't always factor into the lending decision. Yes, an online title loan company may check your credit and ask for employment or job references. Some companies will also ask for bank account information or try to verify a checking account.

This is normal when working with a reputable lender, as it's often part of the check verification process. Despite bad credit, you can still apply for a title loan. There are many lenders who offer bad credit auto title loans if you need money to address an emergency. Simply find the right platform and navigate to their loan application page.

For direct lenders like AmericashPaydayLoans.com, you don't need to worry about your credit score as the loan is secured. So, if you fail to repay the money, the lender can repossess your vehicle. Just like their cousins —payday loans— car title loans impose triple-digit annual interest rates on consumers. And when you combine very high rates with very short repayment periods, it's a recipe for financial disaster.

Borrowers who can't repay the entire loan on time typically wind up rolling these loans over month after month, incurring additional "rollover" fees and interest. If you're in the military, the Military Lending Act protects you and your dependents. The law limits the APR on many types of credit, including payday loans, car title loans, personal loans, and credit cards, to 36%. The law also tells lenders to give you information about your rights and the cost of the loan. If approved, you'll hand over your car title in exchange for the loan. While the lender determines your loan terms, title loans typically have terms of 30 days, similar to payday loans.

This means you'll make one lump-sum payment at the end of your loan period. You're required to make payments on the amount you borrowed, plus any interest and fees. Most lenders charge a monthly fee of 25% of the loan amount, which translates to an annual percentage rate of at least 300%. A title loan is a secured loan that lets borrowers use their vehicle as collateral.

Since your car secures the loan repayment, the lender can repossess your car if you don't repay the loan on time. Title loans are usually short-term, high-interest loans that have few requirements, meaning if you have poor credit, you'll still have an opportunity to qualify. Many times, credit scores and histories aren't considered at all.

According to the Consumer Financial Protection Bureau , 20% of car title loan borrowers have their car seized when they can't repay their loan back in full. Car title loan lenders make the majority of their business off of borrowers who continually take out new loans to cover their old ones. More than half of auto title loans become long-term debt and more than four-in-five auto loans are reborrowed because borrowers can't pay them off in full with one single payment. You can have a "certified-ready" offer and still be turned down for a loan. Because of this, you should look toward alternative financing methods before taking out a title loan.

Moreover, you need to pay your title loan processing fee in addition to the interest every month. The legality of car title loans in New Jersey is problematic for the lender because of the interest rates they usually charge. They often violate New Jersey's usury laws, because they set forth an interest rate cap of 30%, and rates offered by car title lenders are often well in excess of 100%. Getting a conventional loan requires spending much time not only on filling out the forming process but also on waiting when the company makes its final decision. However, waiting for a long time doesn't meet that the client will get approval because most of the organizations also look at credit history.

Title loans are a type of loanthat need or warrant a property as collateral. Title loans can also be referred to as car title loans, auto title loans or secured loan. It mainly deals with the act of using a vehicle title as collateral for the money borrowed. Car Title loans are mostly short-termed, and they do bear higher interest than normal loaning methods. When you need short-term cash, consider whether the risks of car title loans are worth it or not. Take time to explore other options that could cost you less and don't involve the same risks.

One option that people often overlook is a personal loan. It can provide access to cash when you need it, with lower interest rates and longer term options than car title loans. You'll never have to worry about a credit check – we do not run one. That means your credit score is not impacted by obtaining a title loan.

Then, visit a local lending location to complete the process. You could get cash for your auto title in as little as 30 minutes. If you need money for an emergency or to get the rent caught up, this type of loan can be exactly what you need to get some financial peace of mind. An auto title loan allows you to get your title back as soon as you pay off what you owe on the loan. OppLoans provide a reliable alternative to payday and car title loans. While their APRs remain higher than traditional personal loans, the out-of-pocket costs are still less than payday loans.

However, it's good to know the lender is there in case of emergencies. For small-dollar loans, interest rate limits can actually work against consumers' best interests, in part because they reduce consumers' choices. Interest rates are a function of both the size and length of a loan. Also, if a consumer only needs $500, but the smallest loan a lender can afford to make with a 36% APR is $5,000, the lower rate doesn't help that consumer.

The rate may be lower, but the consumer will have to borrow much more than he needs, pay far more in interest, and will be in debt for much longer. In addition, many consumers may not even qualify for a $5,000 loan. Thus, interest rate limits would deprive borrowers of access to the lowest-cost loans that meet their actual needs. Traditional installment loans are nominally higher-rate loans, but are, in fact, low cost for the consumer. Again, this is because these small-dollar loans are paid in fixed installments of mostly principal over a set period of time. Consumers reasonably want safe, responsible, low cost loans.

They are the cousin of unsecured loans, such as payday loans. These fixed-rate installment loans are aimed at people with credit scores of 669 or less, and usually have higher interest rates. We all know how bad credit can increase one's chance of being denied financial loans. Thus, direct lenders of car title loans make the whole process of lending-borrowing a quick one by not conducting a credit check. Even if you contact the bank, no one will give you up to 50,000 thousand dollars in cash in just 24 hours, without a package of documents necessary for lending to the bank. Moorestown title loans are the perfect loan to meet all your needs.

With title loans, your life can only change for the better. We cannot find ways to get instant cash to pay bills or buy some essentials for our everyday purpose. If you apply with multiple title loan lenders the odds are high that you will run across scam companies. Some offshore companies have moved from payday loan scams to those that involve the title loan industry. Be careful and always research a company that funds online title loans.

Find a website or company, that lists their contact info on the homepage. Consider what happens when a potential borrower starts filling out online loan applications. His or her information is shared by the credit reporting agencies with outside entities and marketing firms. This practice makes it easy for unsuspecting consumers to become targets of unlicensed lenders. Borrowers apply for a traditional installment loan at their local consumer finance office, just as they would for an auto loan or mortgage at a credit union or bank. A borrower is required to submit a credit application to the lender.